Where are the best Auto Insurance rates in Cedar Rapids?

Everyone knows that car insurance rates can vary by driver and vehicle as well as risk factors like driving record, vehicle use and mileage. But did you know that you can pay different rates depending on what part of Cedar Rapids you live?

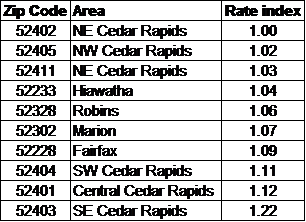

Recently, a customer moved from one Cedar Rapids zip code to another. With no other changes, their auto insurance rate increased by $100 over the 6-month term. I thought it was unusual for such a large difference within Cedar Rapids and was curious how much your zip code affects your auto insurance rates. Using the same customer, I checked rates in each zip code in the metro area and here are the results:

Note: an index of 1.02 means this zip code is 2% more than the 52402 zip. This example was checked on Progressive. Each carrier sets their rating factors with approval from the Iowa Insurance Division who regulates insurance rates in the state of Iowa. Therefore, it’s important to note other carriers will not have the same rate differentials for the same zip codes.

In this example, the driver would pay $231 more in the SE Cedar Rapids zip code versus the NE zip code. I would’ve expected a large rate differential when moving to another state, as Iowa on average has some of the lowest auto insurance rates in the nation.

Why do auto insurance rates vary by location?

Insurers keep claims data by zip code. Those areas with higher rates of losses (insurance claims) will pay more than those with lower rates of loss. A higher number of accidents can lead to increased liability and collision coverage rates. Similarly, more losses from storms, deer strikes, vandalism or theft can lead to paying higher premiums for comprehensive coverage. For example Oklahoma has more severe wind and hail storms than Iowa does. Therefore you’ll pay more there for comprehensive coverage, which covers such loses, than in Iowa due to the increased risk.

It surprised me how much just moving across town, or in some cases just across the street, can affect your auto premiums!

Posted in: Cedar Rapids News, Insurance Tips

Leave a Comment (0) →

Where is St. John XXIII church?

Posted by Ed Faber on November 29, 2016Not quite Fairfax, not Cedar Rapids

I am often asked by friends, “Where is St John XXIII Church anyway?” Dedicated in Feb. 2004 as John XXIII, it is the newest Catholic parish in metro Cedar Rapids. The church was built on an 80-acre farmstead north of Fairfax, IA on 80th St SW. The old farmhouse is now the parish rectory. The new Hwy 100 extension will bring Edgewood Rd NE and Collins Rd within minutes of its doorstep when it is competed in 2020. The quiet country fields are already starting to give way to new housing developments and road expansion. Fairfax has extended its border to the southern property line of the parish and Cedar Rapids will soon be moving in from the north and east.

St. John XXIII parish is in this nebulous area that’s not quite Fairfax and not Cedar Rapids. I call it “Cedarfax,” in the “DMZ” that lies in between. At some point the church property will be incorporated into one of these two cities. However, since churches like other non-profits, don’t pay property taxes there may not be a rush to do so.

Come out and visit our pretty little church in the cornfield while it still is. Over the next 20 years the Cedarfax area is expected to grow by 20,000 – 30,000 in population. The Cedar Rapids Community School District has already purchased land in the area for new schools. Weekend Masses are 4:00 PM Saturday and 8:00 and 10:00 Sunday morning. You can count on our fast-moving pastor, Fr. Dustin Vu, to cheerfully welcome you when you arrive!

Cedarfax, IA

Tags: cedar rapids, Cedarfax, Fairfax, Highway 100 extension, iowa, St. John XXIII parish

Posted in: Cedar Rapids News, Commentary

Leave a Comment (0) →